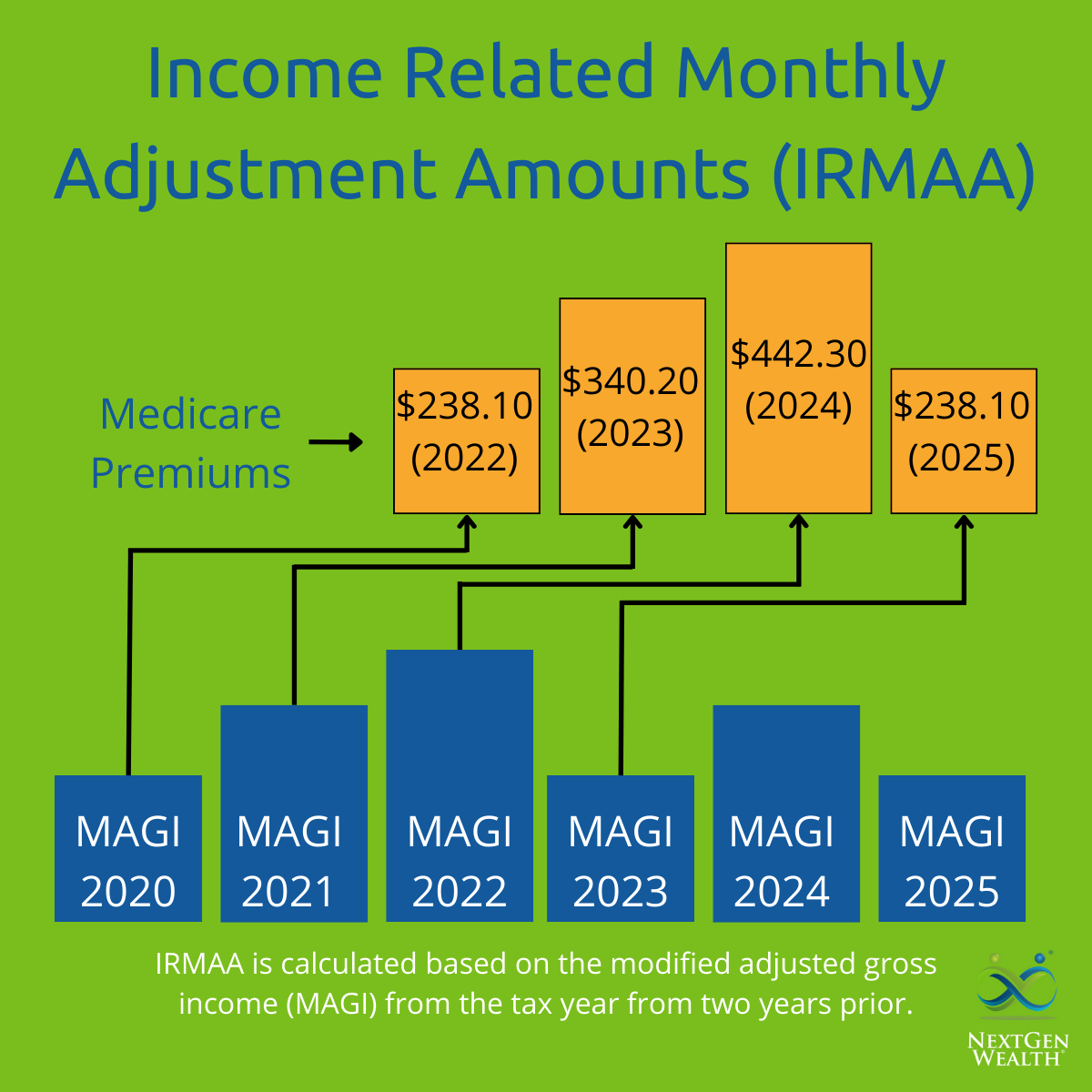

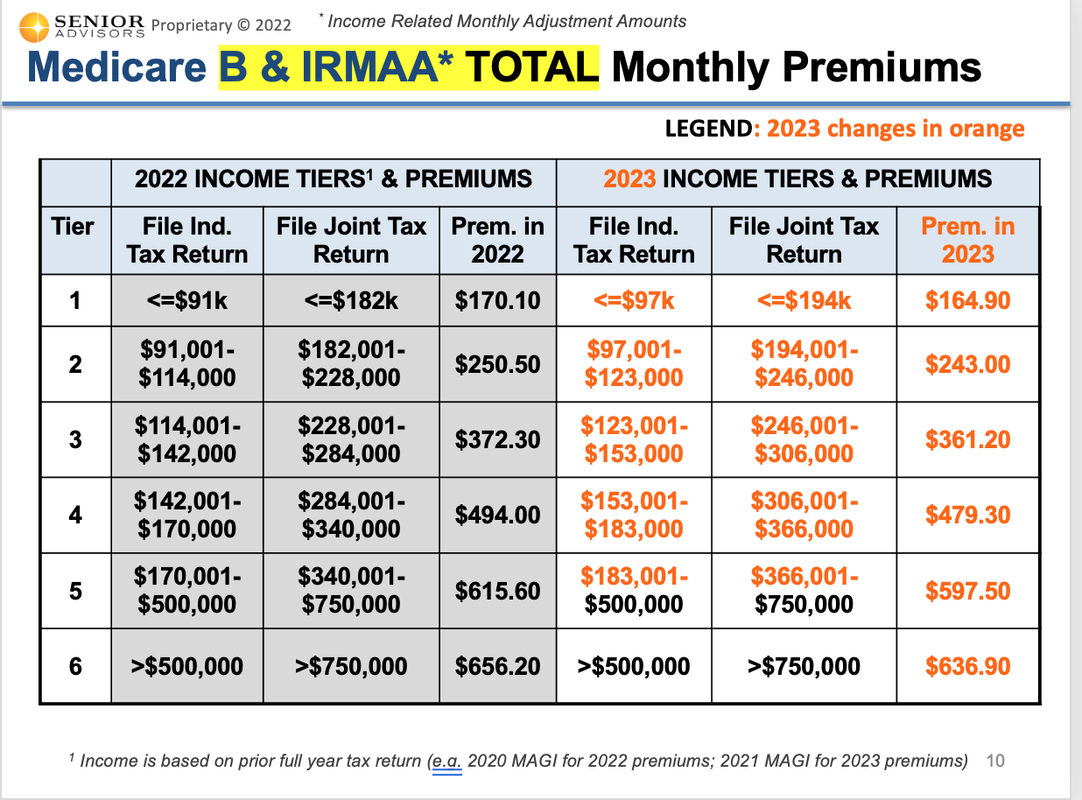

2025 Irmaa Amounts. The 2025 irmaa thresholds will increase by over 5.00% from 2025 and begin at $103,000 for an individual. On october 12, 2025, the centers for medicare & medicaid services (cms) released the 2025 premiums, deductibles, and coinsurance amounts for the medicare part a and.

For 2025, the irmaa thresholds again increased significantly, to $103,000 for a single person and $206,000 for a married couple. To provide a clearer picture, here are the irmaa rates and income thresholds for 2025:

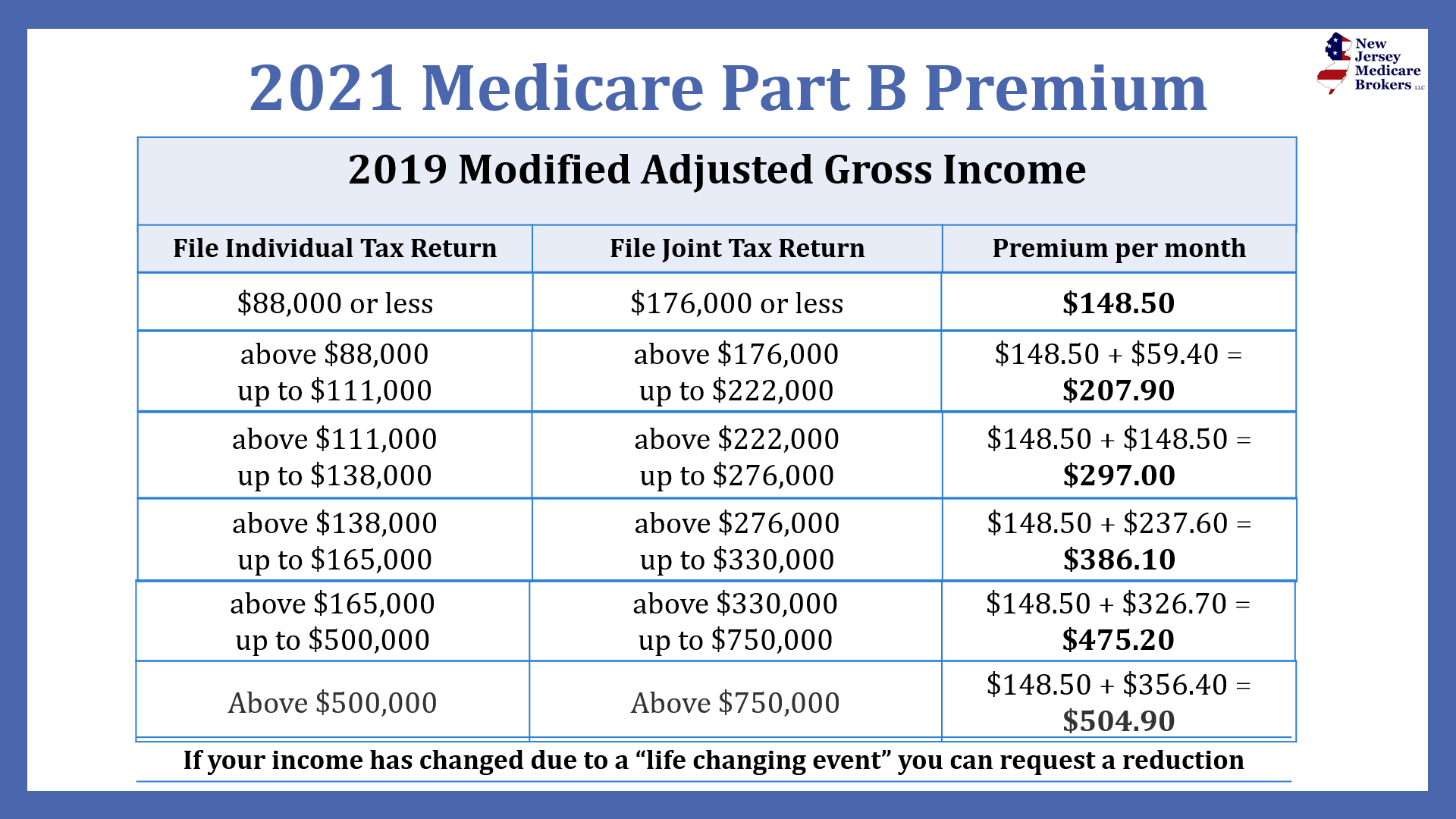

IRMAA Related Monthly Adjustment Amounts Guide to Health, All uninsured seniors with fewer than 30 quarters of coverage and some disabled people who have. To provide a clearer picture, here are the irmaa rates and income thresholds for 2025:

IRMAA Related Monthly Adjustment Amounts Guide to Health, Your final irmaa payment amount depends on your income and your tax filing status. Beneficiary questions an irmaa determination or decision.

Related Monthly Adjustment Amounts (IRMAA) and Medicare Premiums, 2025 medicare full part b: The 2025 irmaa thresholds will increase by over 5.00% from 2025 and begin at $103,000 for an individual.

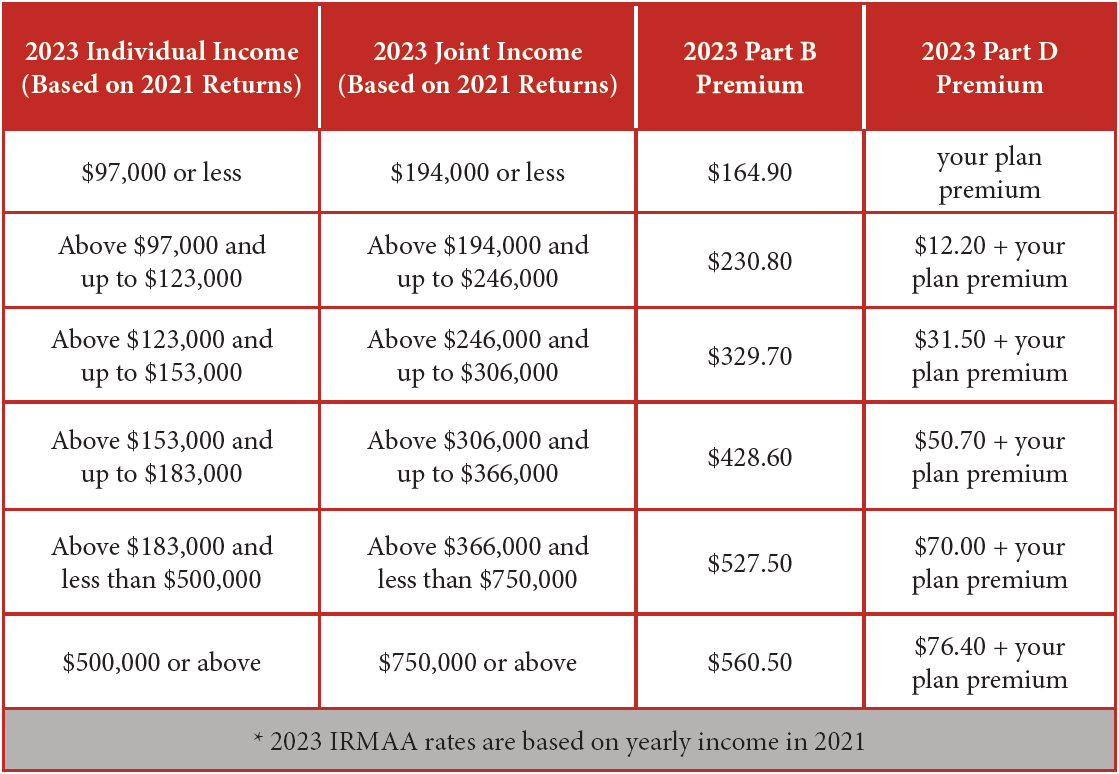

The IRMAA Brackets for 2025 Social Security Genius, Your final irmaa payment amount depends on your income and your tax filing status. The irmaa income brackets for 2025 start at $97,000 ($103,000 in 2025) for a single person and $194,000 ($206,000 in 2025) for a married couple.

2025 Medicare IRMAA Explained YouTube, If income is greater than or equal to $397,000 the irmaa. For 2025, both the irmaa bracket.

Your Guide to 2025 Medicare Part A and Part B BBI, The irmaa calculation takes the agi and tax filing status. This means that the irmaa brackets, by law, will increase at the same rate.

Irmaa Tables For 2025 Maura Nannie, The 2025 income thresholds are $103,000 for individuals and $206,000 for married couples filing jointly. The irmaa calculation takes the agi and tax filing status.

Understanding Medicare and IRMAA Related Monthly Adjustment, Your final irmaa payment amount depends on your income and your tax filing status. In 2025, for single taxpayers with income greater than $103,000 and less than or equal to $129,000 (between $206,000 and $258,000 for joint returns), the.

Medicare Blog Moorestown, Cranford NJ, Here is how you can learn about the change and how to avoid irmaa. The higher the beneficiary’s range of modified adjusted gross.

The IRMAA Brackets for 2025 Social Security Genius, Here is how you can learn about the change and how to avoid irmaa. As long as your total income is less than $94,300 in.

For 2025, if your income is greater than $103,000 and less than $397,000 the irmaa amount is $384.30.

The 2025 income thresholds are $103,000 for individuals and $206,000 for married couples filing jointly.